Confederation Osteuropa

As the aftershocks of the Battle of Castillon began to fade, those who had taken up arms and developed a taste for the nearly ceaseless conflict of the previous 116 years began to foster the mercenary life as a profession. Demand for their services was, as it happened, as keen as supply. Calling on one's many subjects (who likely had been milking cows before being pressed to service) to fulfill their duty as conscripts served little purpose after Castillon, the first significant use of military cannon, other than to provide, what William Makepeace Thackeray would much later so elegantly describe as, "food for powder."1 Of course, the reputation of the Swiss in freeing themselves from the Hapsburg yoke and expanding into Italy commended them to various European princes, as did the ability to "rent out" what was effectively a Cantonal militia and thereby deploy a pre-trained, pre-organized, pre-equipped fighting force to brutally pike to death your irksome neighbors without all the fuss of recruiting and training your own heavy infantry. What resulted was the "Reisläufer." The traveling Swiss warrior.

Overconfidence is a professional hazard for those born Swiss. In 1522 a large block of Swiss pikemen marched cocksure over open ground against a fortification possessed by the Spanish-Imperial and Papal armies resulting in a rout that would become famously known as the Battle of Bicocca. The Spanish artillery and small-arms fire wrecked havoc on the Swiss and their arrogance turned ignominious defeat marked the beginning of the end of Swiss dominance in infantry tactics.

Though decisive, the Battle of Bicocca was not the end of the Swiss military profession and they continued to lease out their services, particularly to the French, until 1858 (and beyond if one counts the odd and defiant Swiss mercenary group fighting for the Republicans in the Spanish Civil War despite an official ban on Swiss mercenaries).

The French were immensely loyal clients when it came to Swiss troops. So much so, in fact, that Swiss troops were guarding the Bastille when it was stormed in 1789. The Swiss were also defending Louis XVI when "the mob" stormed the Palais des Tuileries in 1792. Once again, it was cannon fire, this time in the service of the now rebellious National Guard, that defeated the Swiss, forcing them back through the gardens and to the fountain courtyard where they were divided and slaughtered. Of nearly 1000 guards, 600-650 were killed in the fighting, or hacked down while trying to surrender. Some 50+ Swiss Guard prisoners were marched to a nearby hotel and murdered hours later. Still others were victims of that bloody September, or simply died in prison waiting for a shave from the National Razor.

Unsurprisingly, for years it was Louis XVI, who had been able to escape owing to the Swiss defense, and not "the mob," that was blamed for the wholesale slaughter of the Swiss guard. Even contemporary accounts of the battle bear the hallmarked edits of "victor's history."

In the interim, a great brawl had broken out in the palace, in the Tuileries [gardens], and on the Champs Élysées. The Swiss guards, who had been deceived by the aristocratic instigators in the palace and had fired on the people... were now being hotly pursued and were defending themselves in the same way... so that corpses covered the ground.

The royal palace had been pillaged, although everything of value had been carried scrupulously to the Assembly, which had in turn sent it to the Commune [i.e., city hall]; the people themselves did justice to those who concealed or stole the smallest thing... all the jewels, money, and other valuables found on the dead Swiss guards were carefully gathered up and returned; for instance, a true sans-culotte faithfully deposited 173 gold louis [equivalent to 3,460 livres] that he had discovered on the body of an abbot in the basement of the palace. Our sovereign people, truly French, respected the ladies of honor, or non-honor, of the court; they inflicted not the least scratch on them, ugly as certain of them may be; but they showed no mercy to the obsequious nobles of the court....

The King has been suspended from all his functions and powers; we have driven out his counterrevolutionary ministers and have named others worthy of public confidence. Louis, Antoinette, their children and hangers-on are still in their cell, the stenographer's box, from which they have not budged... and where their fare as this has consisted, deliberately, of scarcely more than bread, wine, and water. Good God, what a sight! It is really true that opinion is often all-important and that without opinion on their side the great, however great they may be, are nothing; these gods on earth, stripped and deprived of their masks... are now not even men, and in the end they have the same fate that false divinities have always had when the blindfolds of error fall away. Our assembly-hall commissioners are taking steps to prepare apartments for them in the former Capuchins' convent [next to the assembly-hall on the west]; for their majesties would run the risk of not being respected as they deserve if they were to go and stay in the Luxembourg Palace, which one of our decrees assigned to them today instead of the Tuileries Palace.2

The King had, in fact, not betrayed his loyal guard. His note to the commander ordering the Swiss Guard to cease fire and return to the barracks (an order which was initially ignored) was later discovered, and survives to this day. Tuileries Palace was burnt to the ground years later during the suppression of the Paris Commune in 1871.

If you wind your way from the waterfront in Lucerne up Lõwenstrasse to Löwenplatz and from there over Denkmalstrasse you will come to the Löwendenkmal, a singularly unique monument. Perhaps one of the best descriptions thereof was penned long ago by an uniquely American author:

The commerce of Lucerne consists mainly in gimcrackery of the souvenir sort; the shops are packed with Alpine crystals, photographs of scenery, and wooden and ivory carvings. I will not conceal the fact that miniature figures of the Lion of Lucerne are to be had in them. Millions of them. But they are libels upon him, every one of them. There is a subtle something about the majestic pathos of the original which the copyist cannot get. Even the sun fails to get it; both the photographer and the carver give you a dying lion, and that is all. The shape is right, the attitude is right, the proportions are right, but that indescribable something which makes the Lion of Lucerne the most mournful and moving piece of stone in the world, is wanting.3

It seems timely to consider the folly of Swiss arrogance and the bloodlust of class-warfare frenzied mobs just now. You can begin to see why when you recognize that, not too long ago, Switzerland started acting quite curiously. Consider:

October, 16 2008:

Pursuant to art. 5 of the Swiss National Bank Act (NBA), the SNB shall contribute to the stability of the financial system. A stable financial system is indispensable for the development of our economy and the proper functioning of our monetary system.

This is why the SNB has decided to extend a loan not exceeding USD 54 billion to the special purpose vehicle (SPV) set up to take over illiquid assets currently held by UBS. A similar offer has also been extended to the CS Group, which has refrained from making use of such a possibility.4

October, 2008

Household borrowing in a foreign currency is a widespread phenomenon in Austria. Twelve percent of Austrian households report their housing loan to be denominated in either Swiss franc or Japanese yen for example. Yet, despite its importance, peculiar character, and immediate policy concerns, we know too little about the attitudes and characteristics of the households involved in this type of carry trade.

We analyze a uniquely detailed financial wealth survey of 2,556 Austrian households to sketch a comprehensive profile of the attitudes and characteristics of the households involved. We employ both univariate tests and multivariate multinomial logit models.

The survey data suggests that risk-loving, wealthy, and married households are more likely to take a housing loan in a foreign currency. High-income households are more likely to take a housing loan in general. These findings may partially assuage policy concerns about household default risk on foreign-currency housing loans.5

November 7, 2008

The Swiss National Bank (SNB) and Narodowy Bank Polski (NBP) are today announcing the establishment of a temporary EUR/CHF swap arrangement. This facility, like the one existing between the SNB and the European Central Bank (ECB), will allow the NBP to provide Swiss franc funding to banks in its jurisdiction in the form of foreign exchange swaps.6

January 21, 2009

In order to fight the crisis, the central banks have lowered their key interest rates aggressively. The instrument of the Swiss National Bank (SNB), the repo rate, has practically reached zero. However, this certainly does not mean that the SNB is incapable of action. If needed, there are other options available. The National Bank can extend the terms of repo transactions or give consideration to the purchase of government and corporate bonds. Where necessary, the SNB may also, for example, sell an unlimited amount of Swiss francs against foreign currency in order to prevent an appreciation of the Swiss franc or even to bring about a depreciation of the national currency.

The SNB is very well aware that the determined route it is pursuing in fighting this historic crisis is associated with long-term risks. At the same time, it is firmly convinced that the risks involved in not following this course would be considerably greater. In this spirit, it is facing up to the task of fighting the crisis while at the same time maintaining a watch on the long-term aspects.7 (Emphasis added)

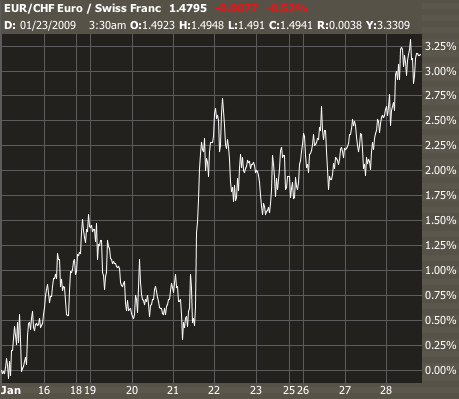

This particular release had a predictable effect on the Euro/Swiss Franc pair:

February 2, 2009

The Swiss National Bank (SNB) is introducing a new monetary policy instrument. It will issue its own debt certificates in US dollars (SNB USD Bills) with terms of less than one year. The instrument will be employed as of mid-February 2009 and will be used until further notice to finance the SNB’s loan to the SNB StabFund.8 (Emphasis added)

This gets substantially less puzzling when one realizes that something like 60% of mortgages in Poland are denominated in Swiss Franc. Other East European countries are in similar predicaments. Hungary's mortgage market has nearly a third of its loans denominated in Swiss Franc. Seeking to attract foreign cash flow, Switzerland actively courted foreign borrowers, particularly from the East, with low rates and liberal underwriting standards. (Cross-border lending has obvious, inherent and deleterious effects on underwriting diligence). More often, Swiss banks lent Francs directly to foreign banks to be used like "feeder funds" to be re-lent to their retail customers. The result was phenomenal growth in Eastern Europe over the last five years and the de facto conversation of the Swiss Franc to the "Dollar of Eastern Europe."9

Now, with the Swiss Franc appreciating against these currencies, many borrowers are finding themselves with twice the effective debt load they bargained for. This puts Switzerland in a difficult position and, at least according to one observer, it makes capital controls in Central and Eastern Europe likely.10 To other more alarmist observers, it might be Swiss bankruptcy.11

The assets of Credit Suisse and UBS together are about $3 trillion against the Swiss national product of about $425 billion. This makes Switzerland look almost Icelandic. If you had plans to flee to Zurich to avoid the nastiness to come in the United States, you might want to rethink your arrangements.

HT: Alea.

- 1. Thackeray's Barry Lyndon (arguably his best work) has this take on conscripted armies of Frederick of Prussia some hundreds of years later: "The great and illustrious Frederick had scores of these white slave-dealers all round the frontiers of his kingdom, debauching troops or kidnapping peasants, and hesitating at no crime to supply those brilliant regiments of his with food for powder."

- 2. "Paris, 10 August, Midnight, In Session," Letter by Michel Azema, Deputy of the Legislative Assembly, as reproduced in "La Révolution Française," #27, Camille Bloch, editor (1894).

- 3. A Tramp Abroad, Mark Twain (1880).

- 4. "Steps to Strengthen the Swiss Financial System," (58KB .pdf file) Speech by Jaen-Pierre Roth, Chairman, Governing Board, Swiss National Bank, October 16, 2008.

- 5. "Borrowing in Foreign Currency: Austrain Households as Carry Traders," (254 KB .pdf file) Beer, Ongena, Peter, Swiss National Bank Working Paper (October 2008).

- 6. "Swiss National Bank and Narodowy Bank Polski Cooperate to Provide Swiss Franc Liquidity," (54KB .pdf file), Press Release, Swiss National Bank, November 7, 2008.

- 7. "The SNB's Ability to Act in the Crisis," (Speech at Universität St. Gallen, Philipp Hildebrand, Vice-Chairman, Governing Board, Swiss National Bank, January 21, 2009. (97KB .pdf Language:DE)

- 8. "Swiss National Bank to Issue SNB Bills in US Dollars," (58 KB .pdf file) Press Release, Swiss National Bank, February 2, 2009.

- 9. "Der Schweiz droht der Bankrott," Claudio Habicht, Tagesanzeiger (February 12, 2009).

- 10. See: "The Return of Capital Controls," Maverecon Blog, Willem Buiter (February 18, 2009).

- 11. "Der Schweiz droht der Bankrott," Claudio Habicht, Tagesanzeiger (February 12, 2009).

Entry Rating: