Fiscal Effects of French Heroin in Drug-Resistant Tuberculosis Patients

To finem respice's way of thinking, the reputation generally afforded Armand Jean du Plessis (the Cardinal Richelieu) as the father of the modern state and modern statecraft is somewhat inflated. The Parisian statesman is routinely credited with exercising a keen financial genius on behalf of the state, winning the "Thirty Years' War" for France, and ushering in a period of enduring French hegemony during his tenure as Louis XIII's "first minister" between 1624 and 1642. All this despite the fact that he left the Royal Treasury nearly empty, the treaties of Osnabrück and Münster (known along with the Peace of Münster as the "Peace of Westphalia") were actually signed six years after his death, and that France's continental domination is generally accepted to have begun much later.

Details, details.

If anything, it is much more accurate to understand Richelieu as one of the early pioneers of authoritarian centralization, a master at manipulating (and a massive beneficiary of) state-dominated crony capitalism of a kind that would not again see the light of day for nearly three centuries, an ingenious architect of novel, punitive, and highly regressive tax schemes disguised as progressive revenue raising initiatives, and a shameless employer of insider dealing.

In short: He was French.

Moreover, the degree to which Richelieu apparently destroyed evidence to conceal his many dealings, both licit and illicit, would impress any contemporary prosecutor or civil litigant seeking to effectuate any sense of meaningful discovery on the Cardinal's tenure. But for Joseph Bergin's brilliant- and shamefully underrated- monograph on the Cardinal's personal finances and their connection to the trappings of power he so obviously enjoyed, the width and depth of crony-lucre that characterized the era of Richelieu's time would likely be lost. Bergin notes:

There remains the most critical and thorny problem of all- to what extent did Richelieu draw substantial revenues of a concealed or illicit kind during his years as a Minister. It has to be said straightaway that he left not a piece of positive evidence with which to answer the question unambiguously. But it will emerge later in this study that, without substantial additions to his known income, he could never have afforded the investments that he made almost every year from the mid-1620s onwards; if one adds to the cost of these investments a sharply rising household budget- it stood at nearly 500,000 livres in 1639- then the gap to be bridged becomes far larger. Despite the extreme care that he took where his personal affairs were concerned, it was inevitable that the inflation of his wealth over the years would provoke comment and speculation from contemporaries as to its true origins; some suggested, either openly or implicitly, that he was not above suspicions. His severest critic, de Morgues, accused him of doing what he pleased with the king's money, and referred in particular to his abuse of the notorious ordonnances de comptant, whereby payments in cash could be made for unspecified reasons and without having to provide an explanation to the chambre des comptes, the crown's vigilant watchdog.

[...]

It appears that from at least the early 1620s, Richelieu was prepared to invest money in the royal tax farms. This was not a matter of purchasing rentes secured against certain indirect taxes such as the gabelles or the aides, which, as we shall see, Richelieu did in any case. Instead, it involved providing cash funds to the tax-farmers, and consequently a right to a share in the profits of their operations.

[...]

As luck would have it, the detailed record of payments by comptants under Richelieu were systematically burned by the official in charge....1

Richelieu apparently had an annual income approaching or exceeding 1,000,000 livres from 1638 until his death in 1642, and one that ranged from 400,000-800,000 in the several years before that. To put this figure in context, Richelieu had been bleeding between 50,000 and 100,000 livres per year prior to his ministerial appointment in 1624 and in 1635 he purchased the Abbey of St. Denis (home of the royal necropolis) for 218,000 livres.2

Despite the personal financial successes he enjoyed during his administration of the King's affairs, and contrary to his enduring reputation as an effective and prosperous steward of the Royal Treasury, there was a serious attempt after his death to open a sweeping investigation into his term and the financial consequences thereof- not least motivated by the desire to lay hands on the bulk of his estate (and not in a healing sort of way either).

Unfortunately, or perhaps fortunately, the Royal Treasury was so strained for cash after his death that the King and Richelieu's successors took great pains to avoid any inquiry that might bring to light the plethora of unsavory means Richelieu had innovated- and that they would now be forced to use to restore some semblance of fiscal sanity to the Monarch's finances.

Yet it should surprise exactly no one at all that the reputation of even a much celebrated French historical figure like Richelieu lacks any semblance of critical stamina. One quickly discovers after undertaking the process just a few times that even the most cursory critique of heretofore highly ennobled French institutions often yields similarly withering results.

Some of the most dramatic and superlative myths surround, for example, the French Foreign Legion. Even on their face such narratives should inspire skepticism. It is, after all, somewhat difficult to credit any post-modern foreign military organization (particularly a European one) that calls Algeria its home with much in the way of combat prowess.

Yes, yes... it is true that the Foreign Legion's real claim to fame has never really revolved around battlefield victories. Instead, its distinctly French appeal- romanticism- was repeatedly inculcated and reinforced primarily by its commanders' propensity to repeatedly place the shock troops of the Legion in engagements that had the effect of annihilating its entire order of battle. In these sorts of circumstances two sorts of people write history: the victors, or the unit historians for formations lacking any survivors- and by extension also lacking any witnesses to the defeat.

While this certainly provides great fodder for heroic "last stand" tales, it is hardly sufficient cause for the mystique the Legion is consistently credited with. One can only watch so many sequels of The Dirty Dozen and, as it happens, none at all if they are dubbed in French. Far be it from finem respice to beg her faithful readers to suspend their disbelief so absolutely as would be required by the suggestion that the French military is a rich hunting ground for combat excellence, but in the same way that Amy Winehouse is a "British 8.0," it bears mentioning that the Colonial Paratroopers certainly deserve much higher praise than the Foreign Legion.

Oddly, the central role played by the First Foreign Parachute Regiment of the Foreign Legion in the Putsch d'Alger (the failed attempt to overthrow Charles de Gaulle organized in Algeria by several retired French generals) is rarely mentioned as prior action in which units of the Foreign Legion distinguished themselves.

Finally, it says something that many consider the defining event of the Foreign Legion's modern character to be the Battle of Dien Bien Phu. It says something else that this particular debacle has been transformed into a tale of mythic heroism for the Legion. In fact, the entire history of the Legion in the First Indochina War provides ample material for authors of heroic "last stand, no survivors" dramatizations- but not much else.

But, though the modern role of the Legion is limited, fear not, dear reader. Any number of other lionized French institutions stand ready to supply ample disillusioning material. (Also, it is difficult to go wrong drowning the shards of shattered dreams by drinking the AOC Côtes de Provence: Sainte-Victoire wines- the vineyards are the Foreign Legion's own, even tended to by active duty personnel).

Lest one be tempted to indulge, for instance, in the franticly maintained fantasy of an innate Franco dedication to liberty, it is occasionally instructive to attempt to publish comments critical of one publicly held French financial institution or another, or, perhaps- sacré bleu!- the French president himself.

In similar fashion, and somewhat curiously, France's 1981 ban on use of the "national razor" appears to have cleansed the bloody history staining the tri-color with some sort of "cognitive bleach." It must rank as one of the most impressive campaigns of brand restoration in... well... ever... that after 200 some years "France" and "liberty" can even appear on the same page together today.

Yes, it is almost old hat to point fingers at various EU members with a critical eye to their worthiness to be members at all. Be this as it may, somehow it has still come to pass that France, its hyper-smug reality distortion field humming away at full power, is mentioned at the tail end of the same breath with Germany- albeit in a sort of quick inhale before the next clause- in describing the economic powerhouse of central-western europe. The selfsame powerhouse, as it happens, that is generally counted on to rescue the Union from the profligate spending habits- poorly concealed even by a decades-long campaign of institutional forgery with respect to official economics statistics reporting- of the "club med" economies.

As with its reputation as a bastion of liberty, however, this automatically formatted economic footnote to the teutonic center of the European Union conceals a poorly researched citation. Far from the cash cow and productivity savior it is alleged to be, la république française is in actuality a quickly metastasizing fiscal cancer, or, perhaps more accurately, afflicted with a very virulent case of extensively drug-resistant pulmonary tuberculosis (hereinafter "XDR-TB") brought on by the criminally negligent mismanagement of what was "merely" a mildly virulent case of multidrug-resistant pulmonary tuberculosis (hereinafter "MDR-TB") before 2006.

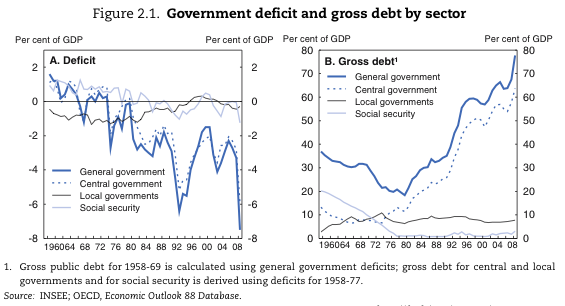

France: Gross Deficit and Debt3

At issue is the fact that France has managed somehow to remain ambulatory even in the face the highly advanced state of its infection, dooming the next generation by wandering around the maternity wards wearing no more than an environmentally-friendly hospital gown (37% less concealing fabric!), slandering its German roommate to anyone who can endure such slurring, beaujolais nouveau tainted breath as it manages to expel between hacking up bloody bits of infectious fiscal lung tissue. Apparently the NRSRO nursing staff has been too cowardly to slap a large yellow and black "biohazard" sign on all of France's border signs. After all, look what happened when the German roommate complained.

Come to think of it, that cough Germany has developed recently sounds a bit worrisome.

There is an interesting sort of positive feedback mechanism built into the periphery of the default event horizon that surrounds sovereign debtors. It works like this:

As state budgets increasingly grow out of control and investors (let us use "bond vigilantes" in today's lecture- just to get Paul Krugman worked into knots, you understand) begin to realize that public spending has started to crowd out what productivity has not already been throttled to death by the tumescent girth of the administrative state, expectations for growth fall. Of course, bond prices drop, and yields (and therefore interest costs to the sovereign) rise. The effect is to exacerbate the fiscal crisis even further. This inevitably spurs calls for spending cuts or, more commonly, "revenue enhancement," which (quelle surprise!) really means more taxes and even more administrative state growth (one wonders, for example, what net change in federal personnel is attributable to the Troubled Asset Relief Program, its administration and the compliance, regulatory, and executive requirements ancillary to the program). This is problematic given that this was the source of the problem to begin with.

On the other side of the coin there is the sing-song chorus of voices bleating in unison to the effect that "austerity" is an exercise in insanity and that, instead, any failure to inject "short term" (this apparently being measured on a geological time scale) stimulus (that is, more spending, more debt) in the face of such a national emergency would have the effect of throwing the country "back into recession."

One sees the threads of positive feedback on the threadbare hems of the emperor's rags immediately:

Do anything but boost spending and the bond vigilantes will sell your yields into the stratosphere faster than you can wire your personal retirement funds to Canada. Do anything but cut spending and the bond vigilantes will sell your yields into the stratosphere faster than you can wire your personal retirement funds to Switzerland. Do nothing and the bond vigilantes will sell your yields into the stratosphere faster than... well, in this case you might have a few weeks of breathing room while they wonder where your press release got to.

It is not as a result of some black, soulless lack of humanity- well, not solely as a result of this- that finem respice will, at this point, be seen to adopt a visage of bored and unsympathetic indifference. In fact, if you detect a decisively subtle hint of a wry smirk, you would probably be safe in assuming it is not simply a trick of the massive amount of heatless light radiating from Le Débat this week.

No, the lack of sympathy astute finem respice readers likely detect is bound up in the fact that these sovereigns have had this coming for decades and the gig is kind of, sort of, maybe finally up.

And this returns us to the essence of the present work's, shall we say, "light motif." Franco (and to a large extent, Euro) austerity panic is a complete sham.

Back in September of 2011 Nicolas Sarkozy's government released its 2012 budget plan. The effort was described by, for instance, HSBC (in somewhat fawning terms) as:

...an intermediate path: reducing the deficit and respecting its budget commitments without allowing these efforts to strain growth.4

This sounds to finem respice suspiciously like:

Do nothing and the bond vigilantes will sell your yields into the stratosphere faster than... well, in this case you might have a few weeks of breathing room while they wonder where your press release got to.

Immediately after HSBC's tepid (but above body temperature) description comes the admission:

According to the government, real public spending is still expected to increase by 0.9% and will make a positive contribution to GDP growth in 2012.5

Normally, astute and loyal readers of finem respice would find themselves stunned to behold the rank indecision, deception (of self and others), and flaccidity implicit in such a meaningless response to fiscal crisis, but before a fatal case of cognitive dissonance sets in the inner monologue circuit breaker kicks in: "Relax, it's France, baby." Oh. Yeah. Almost forgot.

And lest readers start to feel guilty, it is worth noticing that HSBC has clearly been raiding France's medicine cabinet for sedatives too. Consider:

The bright orange decor of the cover page boldly headers the first body text with:

2012 French budget confirms deficit reduction targets...6

...and relegates to the next page...

...but without providing details of the means of public spending cuts, which could soon prove insufficient.7

The body text continues later with:

It was also planned that public spending would be cut by a further EUR 1bn in 2012 but the details of the measures were postponed until the draft budget bill. However, the draft budget bill presented this morning still does not provide any details of measures that will deliver this small EUR 1bn reduction in public spending. It is planned that these measures will be specified during the review by parliament.8

This gives finem respice the opportunity to reuse the always popular snark:

Quelle surprise!

There's more:

This vagueness about public spending cuts is the weak point of the fiscal consolidation program presented by the French government, as it shows that tax rises continue to be favored over spending cuts.9

Does it now. Does it indeed.

To review:

As of September 28, 2011 the French idea of "austerity" consisted of a "reduction in public spending" of EUR 1 billion which would be accomplished by- excuse me just a moment. I have to take this call.

Sorry about that.

...and a nominal 2012 GDP growth forecast of 3.6% with inflation predictions that make this a real 2012 GDP growth forecast of 1.75%.10

It bears mentioning that, tied up at least partially in this GDP growth forecast, there is the assumption that a nearly 1.0% increase in public spending from 2011 levels will contribute to GDP growth.

In addition, the entire French budgetary analysis here is careful to frame the entire deficit reduction target discussion in terms of percentages of GDP. This has the effect of permitting the analysis to sort of grandfather in the rather optimistic French assumptions about growth and inflation into the fiscal austerity narrative. You can "reduce the deficit" in terms of its ratio to GDP by boosting GDP. And since we all know that the French government's sage and productive stewardship of the Treasury is the ultimate source of growth in these difficult times, any "reduction" in the deficit must be credited to the French government. Of course, any miss on these targets will be the fault of unfortunate and unexpected economic malaise in Spain, Italy, Greece and renewed German military aspirations on the continent.

No. Seriously.

HSBC's romance with this approach rivals the on-screen brilliance of the Twilight series. To wit:

The good news is that the government has pledged to respect its target of reducing the deficit reduction to 4.5% of GDP in 2012, even if growth falls short of current expectations. Moreover, with public spending accounting for 56.3% of GDP in 2011, it should be easier to reduce spending than if they were less substantial.11

Famous for her unceasing display of perfect decorum in the face of every social situation, long-time friend of finem respice Laura "The Debt Bitch" was heard to comment on this section with:

If I were curious about the aroma of France's diminutive phallus I need only give HSBC a French kiss.12

Some parsing of this text may be required to absorb the absoluteness of its depravity. (To be clear, finem respice refers here to the HSBC report).

...with public spending accounting for 56.3% of GDP in 2011, it should be easier to reduce spending than if they were less substantial.13

So, to be clear: "Thank god spending is so out of hand!" or "Honey, you'll never guess how much I saved you at Saks today!"?

Also:

...with public spending accounting for 56.3% of GDP in 2011, it should be easier to reduce spending than if they were less substantial.14 (Emphasis added).

Shouldn't it be "if it were less substantial."? And:

...the government has pledged to respect its target of reducing the deficit reduction to 4.5% of GDP in 2012.15

Reduce the reduction? Always sharp finem respice readers can be forgiven for wondering if HSBC France has resorted to rating non-primetime cooking programming.

Later HSBC admits:

Therefore, if growth is weaker than expected by the government in 2012 and closer to our forecast of 1.2%, additional public spending cuts of EUR 23bn would be needed in order to meet the target of a public deficit of 4.5% of GDP in 2012.16

After parsing out HSBC's convoluted text it becomes a simple matter to realize that using the slight of hand created by focusing on percentage of GDP figures combined with the misdirection of inflated GDP growth expectations permits France to claim the austerity merit badge with spending cuts less than 1/20th of the amount that will most probably be required, and to do so with a straight face when actual public spending is slated to rise by nearly 1.0% in the same period.

For reference, quarterly growth in French GDP was 0.9%, -0.1%, 0.3%, and 0.2% in 2011 respectively.17

And, really, it would probably be best to totally ignore the fact that the Bank of France was predicting zero growth for the first three quarters of 2012 back in February of this year.18

But even in the face of these flaws, those circumstances that presently occasion the manic hysteria of Le Débat and the weekend election circus that is to follow really do defy rational thought- even in the rarified air of logic that hangs perpetually over France. How else can one rationalize a situation whereby Francois Hollande has managed to find himself as the odds-on favorite to win Sunday's presidential election in France, chiefly by characterizing the current government's public spending expansion as an evil and unsustainable austerity plan? And somehow prompt the entire European Union to lurch suddenly to the left in the same moment? To wit:

I will renegotiate the treaty. Mrs Merkel knows that. And if the French people give me their backing, my first trip will be to confirm to her that the French people have voted for a different kind of Europe.19

The "treaty" Hollande refers to is, of course, the fiscal pact negotiated by the Eurozone members to limit budget deficits to 3.0% of GDP by 2013 and structural deficits to 0.5% of GDP for countries with government debt levels below 60.0% of GDP. (Care to guess if France exceeds this level?). To frame the matter sharply:

For 2011 France's total budget deficit was around 5.2% of GDP but its structural deficit was calculated as 4.5% of GDP, down a mere 0.5% from 2010.

Read that again:

...its structural deficit was calculated as 4.5% of GDP.

Ouch.

It would therefore appear that while Mr. Sarkozy was merely content with looking the other way while XDR-TB patient France lifted a handful of codeine tablets from Germany's medication tray here and there, Mr. Hollande plans to slip into France's room over the weekend, lock out ward-mate Germany (the last moderating force in France's life and who you may remember as the toughest lover from the last episode of "Budget Intervention"), dim the lights, start cooking up a fat shot of black tar fiscal heroin ("Relax, Francy, baby. In about 2 quarters you won't care about all that square fiscal crisis talk anymore, trust me, sugar.... Daddy's got the best sweet, sweet candy.") before taking certain liberties with the French person, pilfering from the bedside table the last of the mostly ineffectual antibiotics France had been taking, selling them on the black market, and then inviting the rest of the hospital floor over to mainline what's left of the smack with the same needle. Ah... except for Greece, who only gets speedballs. And Germany, who, judging by the sounds emanating from the hall, is probably locked in the utility closet with the mops... with Britain.

But, coming full circle, none of this should surprise the always sharp and attentive finem respice reader. France has been the world heavyweight champion of institutional and fiscal artifice going back to before the time of Richelieu.

The republic's capacity for such overt deception and myth-making is exceeded only by its nearly limitless capacity for self-deception and rationalization. And while they are, all of them, rank amateurs, the other European Union members certainly seem to aspire to achieve France's stature in the area of reflexive fiscal opacity.

The European Union is doomed.

Never before have a more eager bunch of extensively drug-resistant pulmonary tuberculosis hopefuls been collected in this fashion in the same region of space-time.

Well... actually, there was the audience at Invesco Mile High Field on August 28, 2008.

- 1. Bergin, Joseph, Cardinal Richelieu: Power and the Pursuit of Wealth, Yale University Press (1985).

- 2. Ibid.

- 3. OECD Economics Surveys: France 2011, OECD Publishing (March 2011).

- 4. Lemonine, Mathilde, "Flashnote: 2012 French Budget," HSBC Global Research/HSBC France (September 28, 2011).

- 5. Ibid.

- 6. Ibid.

- 7. Ibid.

- 8. Ibid.

- 9. Ibid.

- 10. Ibid. p. 3.

- 11. Ibid. p. 1.

- 12. Text may have been edited for broadcast television.

- 13. Ibid.

- 14. Ibid.

- 15. Ibid.

- 16. Ibid. p. 2.

- 17. Source: National Institute of Statistics and Economic Studies.

- 18. "France's Budget Deficit Falls as Bank of France Forecasts Zero Growth," RFI (February 8, 2012).

- 19. Hewitt, Gavin, "Hollande Prompts EU Austerity Rethink," BBC News (April 26, 2012).

Entry Rating: