Nucleating the False Vacuum of the European Union

When David Eccles was around fourteen his family moved from Scotland to Utah. Once there Eccles assumed such a string of positions, ranging from work on railroads, mills, lumber concerns, and home building, that he eventually amassed a substantial savings. With this cash he became part owner of a saw mill in 1873 before buying out his partners whereupon he began to build a literal industrial empire by following the paths of the railroads (with which he was intimately familiar through the newly founded Eccles/Oregon Lumber Company that supplied railroad ties for the many Railroad concerns in the American West at the time) and founding a slew of new firms to supply the growing demand in the Western United States for everything from electricity, to lumber, and building materials. Eventually, he also helped found short-run railroad lines with a pair of railroad companies, initially to provide transportation for the various goods produced by his manufacturing enterprises. Historians would later point out that the Oregon Lumber Company was known for illegally cutting trees from public lands, and bribing federal inspectors to avoid closer scrutiny. In addition, accusations that the firm committed fraud to obtain title to timberlands have long lingered. A federal suit naming the firm was dismissed (the sometimes cynical and always skeptical finem respice reader might go so far as to say "suspiciously dismissed") on a legal technicality.

Whatever his methods, by 1902 Eccles had also founded or helped found the Utah Construction Company and the Amalgamated Sugar Company. This latter having been created by the combination of the Odgen Sugar Company and the Logan Sugar Company, both founded by Eccles- the former of which served as Eccles' political instrument insofar as he (unsuccessfully) used it to lobby in opposition to the annexation of Hawaii by the United States.

Eccles is widely regarded as Utah's first multimillionaire and at the time of his death in 1912 was serving as President or on the Board of Directors of 47 different firms.

The herculean task of guiding these many enterprises through and beyond the loss of their instrumental and workaholic founder fell to a 22 year old Marriner Stoddard Eccles, one of 21 of David Eccles' descendants (curiously, David Eccles' biography published by the George S. and Delores Dore Eccles Foundation mentions only his second wife, Ellen Stoddard Eccles, and omits any mention of his polygamy or his first wife, Bertha Marie Jensen, and the twelve children she bore him). Marriner expanded his father's interests with great success, particularly in the area of banking, until members of the "Eccles-Browning Affiliated Banks" club spanned a large web intersecting most of the Western States.

Together with his brother George S. Eccles, Marriner founded the First Security Corporation in the summer of 1928. This holding company eventually served as an umbrella company for 20 banks from the Eccles financial empire. Wells Fargo would acquire First Security, which by then had $23 billion in assets and was the second largest independent bank holding company in the Western United States, via a merger in the year 2000 in a transaction that gave First Security shareholders a little over 1/3 of a share of Wells Fargo stock for every First Security share. The resulting swap valued First Security shares at $15.50 each (about or $3.2 billion in the aggregate).

By now the astute and always curious finem respice reader is almost certainly asking: "How did a newly consolidated financial empire consisting primarily of banks in the Western United States not only survive the onset of the Great Depression, which, by unlucky chance, would begin only 16 months later, but thereafter grow to one of the largest independent banking concerns in the United States and continue to endure and thrive for over seven decades?" As indulgent finem respice readers will presently notice, the answer is "simply by being vastly more deceptive than their fellows."

As the long-standing finem respice reader certainly already knows, "confidence" is a regular topic of interest in these pages. Central to finem respice's recurring treatments of the concept of confidence is the recognition that the term "instilling confidence" or "maintaining confidence" in a system has become synonymous with deception. This is particularly so when (as is alarmingly common) "confidence" in a given system is itself based on deception. Dauntingly, nowhere is the unholy trinity of confidence, deception, and markets more apparent than in the world of banking, particularly where the larger goal of political centralization reigns over halls still haunted by the restless and stimulating ghost of that Companion of the Most Honourable Order of the Bath and Fellow of the British Academy also known as the 1st Baron Keynes.

Consider this passage:

The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by the Congress to maintain stability and public confidence in the nation's financial system by:

- insuring deposits,

- examining and supervising financial institutions for safety and soundness and consumer protection, and

- managing receiverships.1

It doesn't take the imagination of Lewis Carroll to dream up a scenario where meeting your organization's mission goal of "..maintain[ing] stability and public confidence in the nation's financial system..." requires one to issue technically true but misleading, or even manifestly untrue statements to "maintain... public confidence." This is partly because the post-modern banking system is inherently unstable. It is, in some sense, in a state of false vacuum- that is, there is a local minimum of stability, but this is not the lowest stability state. The ever-present potential for the banking system to decay into the lowest stability state (everyone keeps their cash under their mattress, or rather, everyone converts out of a local fiat currency to some other medium of exchange, perhaps precious metals, and keeps those under their mattress) means that there is always a rationale, even an incentive, for those charged to "maintain stability... in the nation's financial system" to resort to distortion and even manipulation and deception to meet this goal. Stated another way: A fractional reserve banking system is, at best, only meta-stable.

In some sense then the "nation's financial system" (and here, at least for a brief moment, finem respice refers to many contemporary examples of national and super-national "financial systems") is in perpetual potential crisis mode. Or perhaps simply perpetual crisis mode. There are obvious advantages for would-be central planners if this meta-stable state can be perpetuated. One wonders, for instance, why privately insured, non-lending depository services firms ("banks" that do not lend out depositor money and instead merely provide debit card, checking, payment, and custody services) are not more popular.

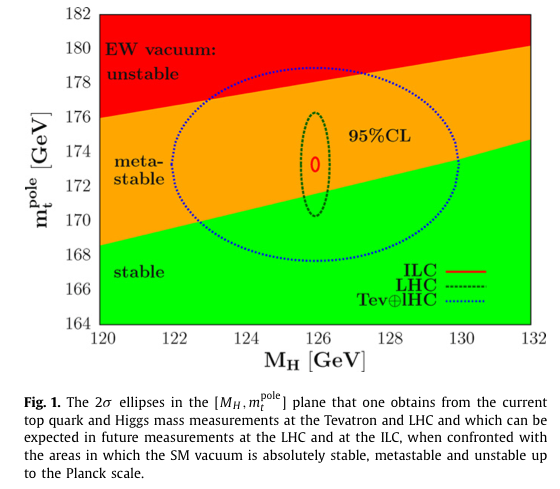

It is perhaps apt (if existentially depressing) to notice that presently an apparent Higgs boson mass of between 124.8 and 126.4 GeV/c22 suggests our particular pocket of the universe might actually be in a false vacuum (e.g. "meta-stable") instead of actually stable.

(Higgs Boson Mass v. Pole Mass of the Top Quark = Electroweak Vacuum Stability)3

In fact, recent results from CERN appear to have pushed the probability envelope for the mass for the Higgs boson even further to the left in Figure I above. Inherent instability appears, at least for the moment to be somewhat... inherent.

On some reflection, it likely occurs to the always sharp finem respice reader that FDIC's mission statement should likely be modified to read:

"...to maintain meta-stability and public confidence in the nation's financial system..."

Being as how the "nation's financial system" is actually in a meta-stable state (some of us in the investing world call this "stable disequilibrium") this might better reflect the dangers and challenges faced by today's modern central planner.

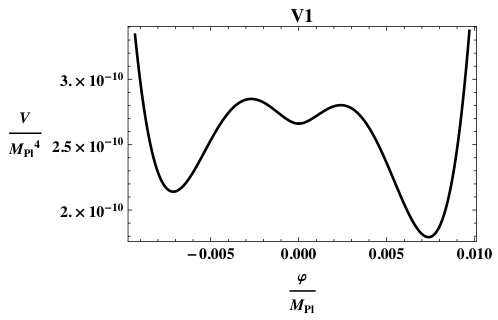

(Figure II: Potentials Giving Rise to Vacuum Bubbles)4

False vacuum states in three dimensions probably decay via nucleation. The resulting effect can seem pretty familiar.5

Returning to earlier themes in the subject matter that is the focus of the instant piece, it is perhaps illuminating to consider the different sorts of deception, manipulation, and artifice that serve to maintain the current energy state within the false vacuum of "stability of the nation's financial system," and prevent the mechanisms that would cause that false vacuum to decay. That is to say, what comprises the twin "humps" on either side of the false vacuum depicted in Figure II above, and what prevents its decay into lower energy states (via nucleating bank runs, perhaps)?

Fortunately, we are provided with a near perfect example in the experiences of one George S. Eccles whom, prior to this moment, was featured in the instant piece only by reference to his more relevant brother, Marriner Stoddard Eccles. George was the "man on the ground" during several bank panics in Utah and personally defended First Security from a number of runs. No less a figure than Milton Friedman cited George Eccles' methodology as the ideal manner in which to counter a bank run. To wit:

In the early 30's some banks in Salt Lake City and surrounding towns began to get into difficulties. The owners of one them were smart enough to see what had to be done to keep their banks open and courageous enough to do it. When fearful depositors began to clamor to withdraw all their money, one of George Eccles jobs was to brief his cashiers on how to handle the run.

George Eccles: Well, then we called all our employees together. And we told them to be at the bank at their place at 8:00 a.m. and just act as if nothing was happening, just have a smile on their face, if they could, and me too. And we have four savings windows and we said, never leave the window. Lunch hour, anything else, we must have every window open all day. But, the important things was we knew you would have a big line so there was no use trying to hurry, because the line was going to continue. So we said, now, when you get a withdraw slip and the passbook, go back and check the signature. Even though you know your friend John Jones, just to delay time, just to mark time and then when you pay the money out, we are not going to pay in $100 bills. We are going to pay in $5, $10 and $20. And count it twice and hand it out with a smile.

Friedman: The banks survived the morning. But they didn't have enough cash left so in the afternoon they called for more from the Federal Reserve Bank.

George Eccles: So the Federal Reserve sent up the armored car, two big sacks full of currency were brought in by the guard crowded through the crowd and the assistant manager, Morgan Kraft, came in also. So Marriner and my brother grabbed Mr. Kraft and he says, now, get up on this marble counter and tell these people that you brought up a lot of money and there is more where that came from! And he did. And then Marriner got up and said now you've heard that story, were not going to close. We're going to stay open as long as any of you people want your money. So don't worry about it at all. Well, of course, you had one other bank in the city and we called him and told him he couldn't close either. He said well I can't I haven't got any money to stay open. So we made him a temporary loan. Because if we had another bank close while this run was going on the psychology of the public would be such that they'd, we'd never break the run in our bank. Everybody would come until they got all of their money out.

Friedman: The bank survived the first day's run. It was time to change psychology. The second day was to be very different.

George Eccles: So that evening we called our employees all together because we knew that the next day that people had been working during the day and would have heard about this and the next morning we'd have them with us. So we figured now we can't let a crowd build up in the lobby. So we told our tellers, I say now, you pay out this money just as fast as you can. So when anybody comes in the front door they don't see a line. You pay out in $100 bills and don't let any line ever develop at your window. Well it never did. So along about noon time people were just coming and going in a normal fashion and the run was over.6

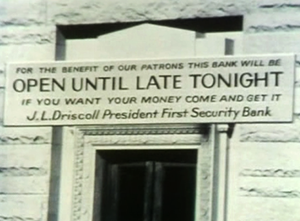

(But Please Don't Want Your Money)

The highly observant finem respice reader will quickly notice the subtle and dark thread shot through what is otherwise intended to be a cheerful story: The wholesale deception of the depositors.

In the early stages of the run much of Eccles' focus was on stalling for time until sufficient cash to solve the bank's liquidity crisis could be arranged, in this case from the Federal Reserve. Even Eccles, at this point, could not be sure that the cash would, in fact, arrive. Concealing any sign of the liquidity crisis that existed was key to his strategy.

Once the cash did arrive Morgan Kraft was prompted to stand up and:

...tell these people that you brought up a lot of money and there is more where that came from!

This may or may not have been true. In fact, in some instances the financial theater of the arrival of an armored car and the transferring of sacks of money into a bank trying to counter a run is dramatized even more by bank management by requesting deliveries of large quantities of $1 bills (which make for more bags delivered with more drama by more armored car guards through a crowd of anxious depositors).

The efforts of the Eccles brothers were perhaps a little less shifty than some of the other grand confidence men of the era, but the essence of the method is the same: just act.

...just act as if nothing was happening, just have a smile on their face, if they could....

The emphasis is to suspend the disbelief of the depositors. Deep down depositors know the truth, no bank keeps enough cash on hand to satisfy its depositors. The music will eventually stop playing and some depositors will be left without a chair. Getting depositors to ignore this (and at their peril, no less) is the essence of "maintain[ing] stability and public confidence in the nation's financial system". The public must believe the lie of stability to be confident in a system that is, at best, only meta-stable. Contrary to the protestations of the FDIC (and central planners everywhere) this does not actually transform a meta-stable system into a stable system. It merely fools less savvy market actors into believing the system is stable.

The Eccles brothers could rightly be said to be masters of the confidence game (it should surprise exactly no one that in 1934 Franklin D. Roosevelt named the very same Marriner Stoddard Eccles that shoved the bag-of-cash wielding Assistant Manager Morgan Kraft up onto the marble countertop to proclaim "...there is more where that came from!" before himself announcing "...we're not going to close. We're going to stay open as long as any of you people want your money..." as the seventh Chairman of the Board of Governors of the Federal Reserve- the same year that Joseph Patrick Kennedy, Sr. was named the first Chairman of the Securities and Exchange Commission). Even as he relates the story of that faithful (or not-so-faithful) day, George S. Eccles literally oozes competence and confidence right through the screen. But what happens when those institutions and individuals charged with maintaining confidence in and the stability of the financial system instead ooze a thick and viscous mucus laced with viral and simply peerless incompetence? For the answer to this question we turn, of course, to Cyprus.

To understand what might occasion a crisis in Cyprus to nucleate into the false vacuum decay of the Euro it is important to comprehend the various environmental elements that form either side of the scalar plot of the European Union's (and Cyprus') false vacuum.

It is important to recognize at the outset that the energy delta between true vacuum and false vacuum in the European Union is severely exaggerated by the lack of fiscal union among the members states to compliment the monetary union among the member states. This and the attendant and chronic overvaluing of the local currency in member states like Greece, Italy, Spain, Portugal, and, of course, Cyprus, is a bit of built-in instability from the outset. Still, there are pronounced "hills" on either side of the European Union's false vacuum.

One of the most critical is the age old scam of "deposit insurance" (would it surprise you, oh finem respice reader, to learn that Marriner Eccles had a hand in the formation of the Federal Deposit Insurance Corporation?) It is representative to say "scam" without a hint of exaggeration when, for example, the Federal Deposit Insurance Corporation presently "insures" on the order of $5.5 trillion in deposits against a backstop of about $25.2 billion in assets in its Deposit Insurance Fund, a figure that dipped over $20 billion into negative territory in late 2009 and early 2010. The key questions that rarely seem to get asked about deposit "insurance" are:

What is being insured against?

Who is the insured?

Who is the insurer?

Much is made now of the fact that many Cypriot depositors are "Russians." Or, to put a finer point on matters "Russian Oligarchs." Shockingly, no one seemed to fret much about the nature of depositors in Cypriot banks when scads of Euros were turning up in the nation's coffers, deposits that were largely responsible for allowing Cyprus to join the European Union in 2004 and continue to be a member in something like good standing (this being, you understand a highly relative term in the European Union where exactly none of the members have ever abided by the letter of their own rules) thus far.

Much can be gleaned from the observation that when it joined the European Union the supposed Cypriot government was not in control of the northern half of the island and that on April 24, 2004 the split island resoundingly rejected the peace plan designed by Kofi Annan to keep Greek and Turkish Cypriots from shooting each other. (The final tally was 31% to 69% against). This is not surprising when one spends the time to discover that, as been a long running theme by Europhiles, membership in the European Union was dangled in front of Cyprus as a means of forcing agreement and unification, rather than for rational economic justifications. The resulting (if temporary) prosperity induced by the massive (relative to Cyprus, you understand) inflow of Euro deposits by expats, Russians, Russian expats, and sundry depositors was immediately cited as a grand victory by Europhiles everywhere (and much scoffing at Kofi Annan's expense was heard- this despite the fact that "Reconciliation and Peace Economics in Cyprus," a project funded by the European Union, concluded in 2012 that: "...little hope for a settlement in the island..." existed7).

Leaving aside for the moment the dangers of treating some depositors as more equal than others when it comes to deposit insurance, it is certainly now worth asking:

What is being insured against?

This is somewhat vague but it seems clear that one of the answers is probably not: "confiscatory ex post facto taxation." Apparently, this is somehow distinct from "loss." This "deposit insurance only covers bank failure and not a one time levy on deposits" argument is particularly obtuse sounding to anyone with sufficient powers of observation to notice that, given that the stated rationale for the "one time levy on deposits" is to prevent bank failure, and if we credit that assertion as true, it follows then that absent the "one time levy on deposits" (read: "confiscatory ex post facto tax") many Cypriot banks would likely fail. In that instance the deposits would, like magic, suddenly be insured again. This raises several questions that, so far as finem respice has been able to determine, have not yet been answered. For example:

Q. Does it not defeat the purpose of deposit insurance if the insurer can unilaterally seize deposits to avoid conditions that would trigger paying depositors their promised deposit insurance guarantees?

One section in the "Citizens' Summary" of the European Commissions legislative proposal (since adopted)8 to revise the European Union "Directive on Deposit Guarantee Schemes" contains this passage of note:

Who Would Benefit and How?

Citizens and businesses – their savings would be better protected, and they could choose the best deposit product in any EU country without worrying about differences in protection.

Banks – they could offer competitive products throughout the EU without being hampered by national differences in deposit protection.

Taxpayers – better-financed schemes would make government intervention – using taxpayers' money – much less necessary.

Certainly, Cypriot taxpayers must feel quite soothed that the European Commission has so thoughtfully protected them from the ravages of funding government intervention to save their ban... oh... oops.

Q. Do European Officials believe that no one in Cyprus (or Europe) has noticed that Cypriot depositors are being asked to pay for the very scam that loopholes Cyprus out of paying off on deposit insurance promises on which these many depositors have surely relied?

Q. What color is the sky in the European Union?

Alright then, what about:

Who is the insured?

The answer to this question apparently has the half-life of half of a news cycle. Possible answers (from most expansive to least) include:

Every account up to EUR 100,000

Every depositor (as distinct from every account) up to an aggregate of EUR 100,000

Every account that has a balance under EUR 100,000 (but not accounts with higher balances)

Every depositor that has an aggregate balance under EUR 100,000 (but not depositors with higher balances)

There has also been talk of exempting or not exempting certain types of businesses or depositors (military, foreign, local, etc.) from the levy. Does perhaps the aforementioned Citizens' Summary have something to say about the result of the "Directive on Deposit Guarantee Schemes" on the subject of depositor priority? Why yes, it does!

What Exactly Would Change?

Depositors would be repaid up to €100 000 within one week.

All banks throughout the EU would provide a uniform level of protection to depositors –

whether citizens or small businesses.

All schemes would have to build up a fund over time to repay depositors when needed. If necessary, banks would also have to make ad hoc contributions.

Depositors would be given information on how their deposits are protected when they sign a contract with a bank. Up-to-date information would be provided on account statements.

Riskier banks would pay higher contributions to schemes. (Emphasis added).

Alright, so what else?

Who is the insurer?

Seems sort of like the same party that is inducing the "loss."

You know, on just a little bit of reflection, deposit insurance in the European Union doesn't seem particularly reassuring.

Ok fine. But deposit insurance isn't the only environmental element that purports to pull the energy levels around the European Union's false vacuum up. The "free movement of capital" is routinely cited as one of the central "four freedoms" that make the European Union a confidence inspiring entity. Really, the European Union is very serious about its "four freedoms." We know this because the European Union says so in no less than the body of its founding documents. For instance, right here:

The internal market shall comprise an area without internal frontiers in which the free movement of goods, persons, services and capital is ensured in accordance with the provisions of the Treaties (except for Russians).9

And here:

Within the framework of the provisions set out in this Chapter, all restrictions on the movement of capital between Member States and between Member States and third countries shall be prohibited.

Within the framework of the provisions set out in this Chapter, all restrictions on payments between Member States and between Member States and third countries shall be prohibited.10

It is when one cites these provisions against the fact that Cyprus has frozen all deposit accounts, forbidden transfers out of the country (or even between Cypriot accounts), repeatedly declared emergency bank holidays, and choked off ATM withdraws from EUR 1,000 per day down to EUR 600 per day, then EUR 400 per day, and most recently down to EUR 100 per day that some Europhile will stand bolt upright in his chair and rudely announce (right in the middle of the group recitation of the Serenity Prayer) "But there's an exception for taxation and that obviously includes a one-time levy." (Europhiles prefer to avoid using the word "tax" unless it is absolutely necessary). Calmly replying with the simple "And can you identify such a tax? One that has, you know, actually been passed by the national legislature in Cyprus? And, forgive me for being so bold, but maybe signed by the executive?" will cause a flurry of European Commission jargon followed quickly by profuse, nervous sweating before the Europhile in question will abruptly excuse himself on account of an urgent meeting he has suddenly remembered. Since said meeting is with the Europhile's Valium dealer you can be assured that in short order the Europhile will laying fully clothed in a hotel bathtub and only able to score as high as a 7 on the Glasgow Coma Scale owing to his slurred muttering on the topic of capital controls in response to painful stimuli (usually abruptly shouting "Baroness Thatcher!" works well). It is from this repose that he will deliver his acceptance speech for the Nobel Peace Prize.

Once one realizes that these institutional fibs (unfettered access to funds, the safety of deposits, a lack of regime uncertainty, legally guaranteed equality for citizens, and guaranteed freedom of movement of capital- elemental freedoms that are supposedly instrumental to the legal system they form) are the energy peaks that maintain the false vacuum, one cannot help but notice that, contrary to the expertise of the Eccles, the great minds of the European Union seem fiercely determined to trigger the decay of the false vacuum in which they presently reside. Well, either that or they simply find it difficult to prevail in a "3 of 5" Tick-Tac-Toe match with the top quartile of the Sea Cucumber population.

- 1. "FDIC Mission, Vision, and Values," Federal Deposit Insurance Corporation (May 4, 2009).

- 2. Taking the high end of measurement from the ATLAS team and the low end from the CMS team.

- 3. Alekhin et. al, "The Top Quark and Higgs Boson Masses and the Stability of the Electroweak Vacuum," Physics Letters B (August 16, 2012).

- 4. Johnson et. al., "Determining the Outcome of Cosmic Bubble Collisions in Full General Relativity," American Physical Society (April 19, 2012).

- 5. For an outstanding animated simulation see also: "False Vacuum Decay," a video developed by Joel Thorarinson in support of Gleiser, et. al. "Bubbling the False Vacuum Away," Department of Physics and Astronomy, Dartmouth College (2007). In some sense it looks like the spread of pathogens. Or perhaps "financial contagion"?

- 6. The always sharp finem respice reader will find much to commend the excellent "Anatomy of a Crisis" installment of Milton Friedman's comprehensively excellent (if charmingly dated) "Free to Choose" series.

- 7. Flynn et. al., "Reconciliation and Peace Economics in Cyprus," University of the West of England (February 2012).

- 8. Directive 2009/14/EC

- 9. The Treaty on the Functioning of the European Union, Part III, Title I, Article 26(2) (2008). (Some text may be fabricated).

- 10. The Treaty on the Functioning of the European Union, Part III, Title IV, Article 63(1-2) (2008) (ex Article 56 TEC).

Entry Rating: